December 2015 Endowment Quarterly Investment Report

Performance Review

University of Guelph Endowment Funds

4th Quarter 2015

Prepared by:

Pavilion Advisory Group Ltd.

1250 René-Lévesque Blvd. West. Suite 4030

Montreal, Quebec

H3B 4W8 Canada

Endowment Funds Results Overview

(Gross Returns for the 12 months ended December 31st, 2015)

The Total Endowment Funds returned 2.9% for the last 12 months versus 8.6% for the benchmark.

| Canadian Equity | U.S. Equity |

|---|---|

|

|

| Non-North American Equity | Fixed Income |

|

|

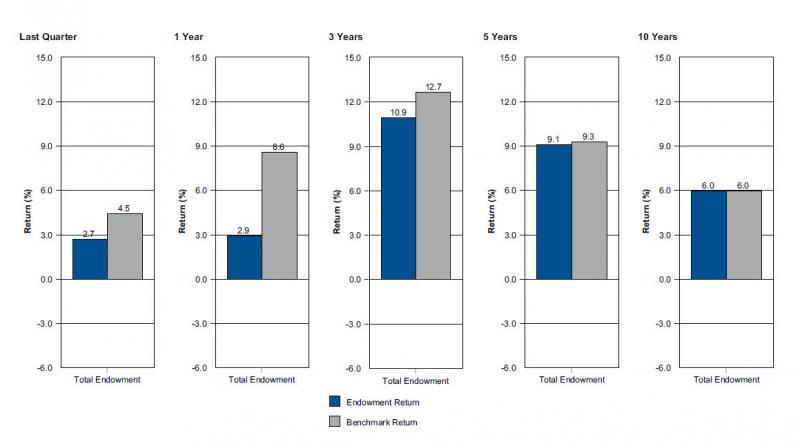

Total Endowment Portfolio Vs Endowment Policy Benchmark

As of December 31, 2015 (Gross of Fees, Annualized for Periods over 1 Year)

Returns are presented gross of fees in CAD.

Endowment Policy Benchmark: 27.5% FTSE TMX Bond Universe + 5% Infrastructure (CPI+5%) + 20% S&P/TSX Composite + 25% S&P 500 ($CAD) + 17.5% MSCI EAFE Net ($CAD) + 5% MSCI Emerging Markets Index.

Annualized Asset Class Performance

As of December 31, 2015 (Gross of Fees)

| Allocation | Performance(%) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Market Value ($) | % of portfolio | Year to Date | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | 6 Years | 7 Years | 8 Years | 9 Years | 10 Years | |

| Canadian Equity | 55,115,389 | 16.4 | -11.7 | -11.7 | -2.6 | 4.9 | 6.6 | 4.0 | 5.5 | 8.7 | 3.7 | 4.0 | 4.9 |

| S&P/TSX Composite Index | -8.3 | -8.3 | 0.7 | 4.6 | 5.3 | 2.3 | 4.7 | 8.6 | 2.2 | 3.0 | 4.4 | ||

| Relative Performance | -3.4 | -3.4 | -3.3 | 0.3 | 1.3 | 1.7 | 0.8 | 0.1 | 1.5 | 1.0 | 0.5 | ||

| US Equity | 88,511,405 | 26.3 | 16.2 | 16.2 | 20.3 | 27.4 | 24.4 | 19.7 | 19.4 | 18.2 | 13.2 | 9.3 | 10.1 |

| S&P 500 | 21.7 | 21.7 | 22.8 | 28.6 | 24.7 | 20.4 | 18.4 | 16.8 | 11.2 | 8.5 | 9.2 | ||

| Relative Performance | -5.5 | -5.5 | -2.5 | -1.2 | -0.3 | -0.7 | 1.0 | 1.4 | 2.0 | 0.8 | 0.9 | ||

| Non-North American Equity | 73,264,592 | 21.7 | 18.2 | 18.2 | 11.5 | 18.1 | 17.7 | 13.5 | 12.1 | 13.3 | 7.8 | 4.6 | 6.7 |

| MSCI EAFE (net) | 19.0 | 19.0 | 11.1 | 17.3 | 16.7 | 10.8 | 9.3 | 9.7 | 3.8 | 2.7 | 4.8 | ||

| Relative Performance | -0.8 | -0.8 | 0.4 | 0.8 | 1.0 | 2.7 | 2.8 | 3.6 | 4.0 | 1.9 | 1.9 | ||

| Emerging Markets Equity | 16,208,012 | 4.8 | -2.6 | -2.6 | 3.4 | 4.4 | 8.1 | 2.8 | N/A | N/A | N/A | N/A | N/A |

| MSCI Emerging Markets Index | 2.5 | 2.5 | 4.7 | 4.6 | 7.3 | 2.2 | 3.9 | 9.7 | 1.4 | 3.2 | 5.8 | ||

| Relative Performance | -5.1 | -5.1 | -1.3 | -0.2 | 0.8 | 0.6 | N/A | N/A | N/A | N/A | N/A | ||

| Canadian Fixed Income | 83,934,180 | 24.9 | 3.6 | 3.6 | 6.2 | 3.7 | 4.1 | 5.0 | 5.4 | 5.9 | 5.7 | 5.3 | 5.2 |

| FTSE TMX Canada Universe Bond Index | 3.5 | 3.5 | 6.1 | 3.6 | 3.6 | 4.8 | 5.1 | 5.2 | 5.3 | 5.1 | 5.0 | ||

| Relative Performance | 0.1 | 0.1 | 0.1 | 0.1 | 0.5 | 0.2 | 0.3 | 0.7 | 0.4 | 0.2 | 0.2 | ||

| Infrastructure | 19,237,529 | 5.7 | 33.5 | 33.5 | 22.2 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CPI + 5% | 6.7 | 6.7 | 6.6 | 6.5 | 6.4 | 6.6 | 6.7 | 6.7 | 6.6 | 6.7 | 6.7 | ||

| Relative Performance | 26.8 | 26.8 | 15.6 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||

| Internal Cash | 4,933,237 | 1.5 | -1.8 | -1.8 | -1.8 | -1.8 | -1.3 | 0.2 | 1.6 | 1.4 | 1.6 | N/A | N/A |

| FTSE TMX Canada 91 Day T-Bill | 0.6 | 0.6 | 0.8 | 0.8 | 0.9 | 0.9 | 0.8 | 0.8 | 1.1 | 1.5 | 1.7 | ||

| Relative Performance | -2.4 | -2.4 | -2.6 | -2.6 | -2.2 | -0.7 | 0.8 | 0.6 | 0.5 | N/A | N/A | ||

| Total Endowment (Net of Fees) | 337,087,797 | 100.0 | 2.3 | 2.3 | 6.2 | 10.3 | 10.7 | 8.6 | 8.8 | 9.6 | 6.0 | 4.5 | 5.4 |

| Endowment Policy Benchmark | 8.6 | 8.6 | 10.1 | 12.7 | 11.9 | 9.3 | 9.2 | 9.8 | 5.8 | 5.0 | 6.0 | ||

| Relative Performance | -6.3 | -6.3 | -3.9 | -2.4 | -1.2 | -0.7 | -0.4 | -0.2 | 0.2 | -0.5 | -0.6 | ||

| Total Endowment (Gross of Fees) | 337,087,797 | 100.0 | 2.9 | 2.9 | 6.8 | 10.9 | 11.3 | 9.1 | 9.4 | 10.1 | 6.6 | 5.0 | 6.0 |

| Endowment Policy Benchmark | 8.6 | 8.6 | 10.1 | 12.7 | 11.9 | 9.3 | 9.2 | 9.8 | 5.8 | 5.0 | 6.0 | ||

| Relative Performance | -5.7 | -5.7 | -3.3 | -1.8 | -0.6 | -0.2 | 0.2 | 0.3 | 0.8 | 0.0 | 0.0 | ||

| Total Endowment ex. Currency Hedge | 341,204,345 | 101.2 | 7.7 | 7.7 | 9.9 | 13.6 | 13.2 | 10.7 | N/A | N/A | N/A | N/A | N/A |

| Endowment Policy Benchmark | 8.6 | 8.6 | 10.1 | 12.7 | 11.9 | 9.3 | 9.2 | 9.8 | 5.8 | 5.0 | 6.0 | ||

| Relative Performance | -0.9 | -0.9 | -0.2 | 0.9 | 1.3 | 1.4 | N/A | N/A | N/A | N/A | N/A | ||

| Effect of Passive Currency Hedge | -4.8 | -4.8 | -3.1 | -2.7 | -1.9 | -1.6 | N/A | N/A | N/A | N/A | N/A | ||

Endowment Policy Benchmark: 27.5% FTSE TMX Bond Universe + 5% Infrastructure (CPI+5%) + 20% S&P/TSX Composite + 25% S&P 500 ($CAD) + 17.5% MSCI EAFE Net ($CAD) + 5% MSCI Emerging Markets Index.

All returns are reported gross of fees in CAD except for the Total Endowment where returns are displayed both net and gross of fees. EAFE stands for Europe, Australasia and Far East. Cash amounts and percentages presented exclude residual manager cash balances and currency overlay (currency hedging).

Annual Asset Class Performance

(Gross of Fees)

| Performance(%) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Jan-2015 To Dec-2015 | Jan-2014 To Dec-2014 | Jan-2013 To Dec-2013 | Jan-2012 To Dec-2012 | Jan-2011 To Dec-2011 | Jan-2010 To Dec-2010 | Jan-2009 To Dec-2009 | Jan-2008 To Dec-2008 | Jan-2007 To Dec-2007 | Jan-2006 To Dec-2006 | |

| Canadian Equity | -11.7 | 7.5 | 21.6 | 11.7 | -5.5 | 13.0 | 30.5 | -25.7 | 6.3 | 14.2 |

| S&P/TSX Composite Index | -8.3 | 10.6 | 13.0 | 7.2 | -8.7 | 17.6 | 35.1 | -33.0 | 9.8 | 17.3 |

| Relative Performance | -3.4 | -3.1 | 8.6 | 4.5 | 3.2 | -4.6 | -4.6 | 7.3 | -3.5 | -3.1 |

| US Equity | 16.2 | 24.4 | 43.0 | 15.9 | 2.6 | 18.0 | 10.9 | -16.5 | -17.4 | 17.9 |

| S&P 500 | 21.7 | 23.9 | 41.2 | 13.5 | 4.6 | 9.1 | 7.7 | -21.4 | -10.6 | 15.4 |

| Relative Performance | -5.5 | 0.5 | 1.8 | 2.4 | -2.0 | 8.9 | 3.2 | 4.9 | 6.8 | 2.5 |

| Non-North American Equity | 18.2 | 5.2 | 32.6 | 16.6 | -2.1 | 5.4 | 20.9 | -24.0 | -17.9 | 27.4 |

| MSCI EAFE (net) | 19.0 | 3.6 | 31.0 | 14.8 | -10.0 | 2.1 | 12.2 | -29.3 | -5.8 | 25.9 |

| Relative Performance | -0.8 | 1.6 | 1.6 | 1.8 | 7.9 | 3.3 | 8.7 | 5.3 | -12.1 | 1.5 |

| Emerging Markets Equity | -2.6 | 9.7 | 6.4 | 20.0 | -15.9 | N/A | N/A | N/A | N/A | N/A |

| MSCI Emerging Markets Index | 2.5 | 7.0 | 4.3 | 16.1 | -16.2 | 13.0 | 52.4 | -41.6 | 18.5 | 32.1 |

| Relative Performance | -5.1 | 2.7 | 2.1 | 3.9 | 0.3 | N/A | N/A | N/A | N/A | N/A |

| Canadian Fixed Income | 3.6 | 8.9 | -1.0 | 5.3 | 8.7 | 7.0 | 8.9 | 4.4 | 2.7 | 4.0 |

| FTSE TMX Canada Universe Bond Index | 3.5 | 8.8 | -1.2 | 3.6 | 9.7 | 6.7 | 5.4 | 6.4 | 3.7 | 4.1 |

| Relative Performance | 0.1 | 0.1 | 0.2 | 1.7 | -1.0 | 0.3 | 3.5 | -2.0 | -1.0 | -0.1 |

| Infrastructure | 33.5 | 11.8 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CPI + 5% | 6.7 | 6.6 | 6.4 | 6.0 | 7.3 | 7.5 | 6.4 | 6.2 | 7.6 | 6.8 |

| Relative Performance | 26.8 | 5.2 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Internal Cash | -1.8 | -1.8 | -1.9 | 0.0 | 6.7 | 9.1 | 0.3 | 2.6 | N/A | N/A |

| FTSE TMX Canada 91 Day T-Bill | 0.6 | 0.9 | 1.0 | 1.0 | 1.0 | 0.5 | 0.6 | 3.3 | 4.4 | 4.0 |

| Relative Performance | -2.4 | -2.7 | -2.9 | -1.0 | 5.7 | 8.6 | -0.3 | -0.7 | N/A | N/A |

| Total Endowment (Net of Fees) | 2.3 | 10.2 | 19.1 | 12.0 | 0.3 | 9.8 | 14.4 | -15.6 | -7.1 | 14.4 |

| Endowment Policy Benchmark | 8.6 | 11.7 | 17.9 | 9.7 | -0.6 | 8.5 | 13.6 | -18.2 | -1.1 | 14.9 |

| Relative Performance | -6.3 | -1.5 | 1.2 | 2.3 | 0.9 | 1.3 | 0.8 | 2.6 | -6.0 | -0.5 |

| Total Endowment (Gross of Fees) | 2.9 | 10.8 | 19.6 | 12.5 | 0.8 | 10.5 | 14.9 | -15.2 | -6.7 | 14.7 |

| Endowment Policy Benchmark | 8.6 | 11.7 | 17.9 | 9.7 | -0.6 | 8.5 | 13.6 | -18.2 | -1.1 | 14.9 |

| Relative Performance | -5.7 | -0.9 | 1.7 | 2.8 | 1.4 | 2.0 | 1.3 | 3.0 | -5.6 | -0.2 |

| Total Endowment ex. Currency Hedge | 7.7 | 12.3 | 21.4 | 11.9 | 1.2 | N/A | N/A | N/A | N/A | N/A |

| Endowment Policy Benchmark | 8.6 | 11.7 | 17.9 | 9.7 | -0.6 | 8.5 | 13.6 | -18.2 | -1.1 | 14.9 |

| Relative Performance | -0.9 | 0.6 | 3.5 | 2.2 | 1.8 | N/A | N/A | N/A | N/A | N/A |

Endowment Policy Benchmark: 27.5% FTSE TMX Bond Universe + 5% Infrastructure (CPI+5%) + 20% S&P/TSX Composite + 25% S&P 500 ($CAD) + 17.5% MSCI EAFE Net ($CAD) + 5% MSCI Emerging Markets Index.

All returns are reported gross of fees in CAD except for the Total Endowment where returns are displayed both net and gross of fees. EAFE stands for Europe, Australasia and Far East. Cash amounts and percentages presented exclude residual manager cash balances and currency overlay (currency hedging).

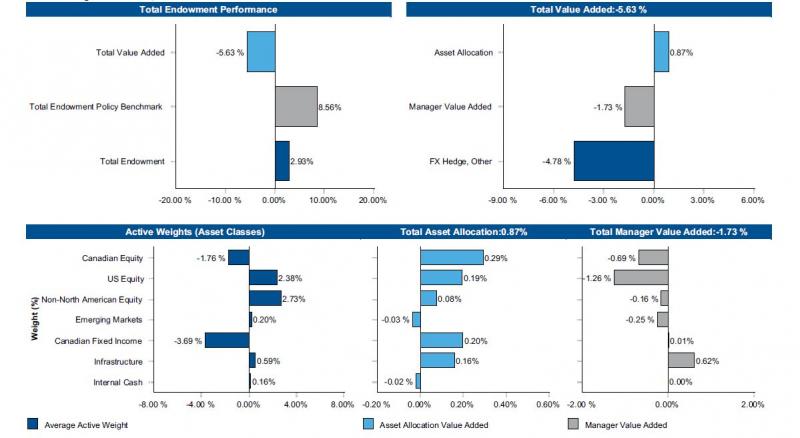

Performance Attribution

Total Endowment Funds Vs Endowment Policy Benchmark

1 Year Ending December 31, 2015

Returns are presented gross of fees in CAD.

Endowment Policy Benchmark: 27.5% FTSE TMX Bond Universe + 5% Infrastructure (CPI+5%) + 20% S&P/TSX Composite + 25% S&P 500 ($CAD) + 17.5% MSCI EAFE Net ($CAD) + 5% MSCI Emerging Markets Index.

The Benchmarks do not assume currency hedging.

“Other” includes the effects of all other factors on the Total Endowment's relative returns, including rebalancing and residual trading activity.

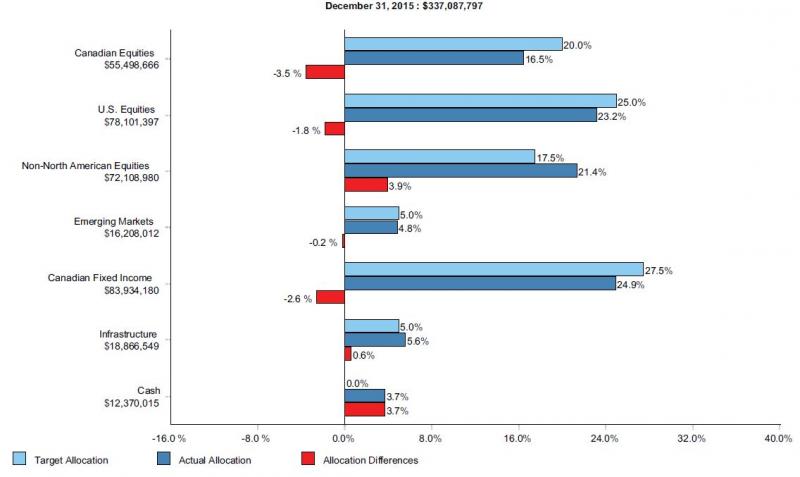

Endowment Asset Mix

Actual Allocation vs. Investment Policy Allocation

As of December 31, 2015

Note: This actual allocation displays the aggregate managers' holdings regardless of their mandate. Cash includes internal cash directly owned by the Endowments and manager residual cash balances (data from CIBC Mellon).

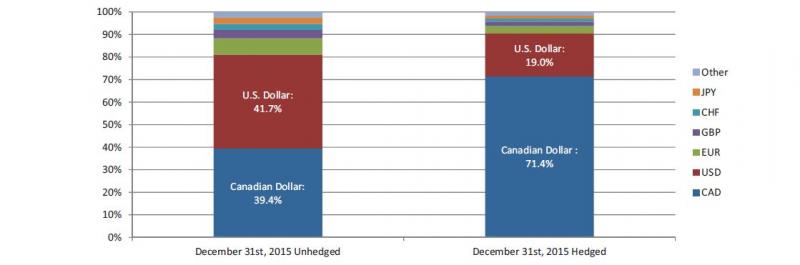

Endowment Currency Exposure

As of December 31st, 2015

| Currency | December 31st,2015 Unhedged | Gross Exposure(CAD) | Hedge(CAD) | December 31st, 2015 Hedged | Net Hedged Exposure(CAD) |

|---|---|---|---|---|---|

| Canadian Dollar | 39.4% | 134,415,509 | 106,410,738 | 71.4% | 240,826,247 |

| U.S. Dollar | 41.7% | 142,438,474 | -78,383,255 | 19.0% | 64,055,219 |

| Euro | 7.1% | 24,353,668 | -12,957,079 | 3.4% | 11,396,589 |

| British Pound | 3.8% | 12,834,492 | -6,496,878 | 1.9% | 6,337,614 |

| Swiss Franc | 2.7% | 9,251,457 | -4,662,628 | 1.4% | 4,588,829 |

| Japanese Yen | 2.7% | 9,283,950 | -4,755,766 | 1.3% | 4,528,184 |

| Other | 2.5% | 8,626,795 | -3,271,680 | 1.6% | 5,355,115 |

Note: The Net Hedged Exposure equals the fund’s original currency exposure to its total investments (Gross Exposure) plus the currency hedge implemented by Mesirow, which is designed to protect the Endowment funds from excessive foreign currency fluctuations.

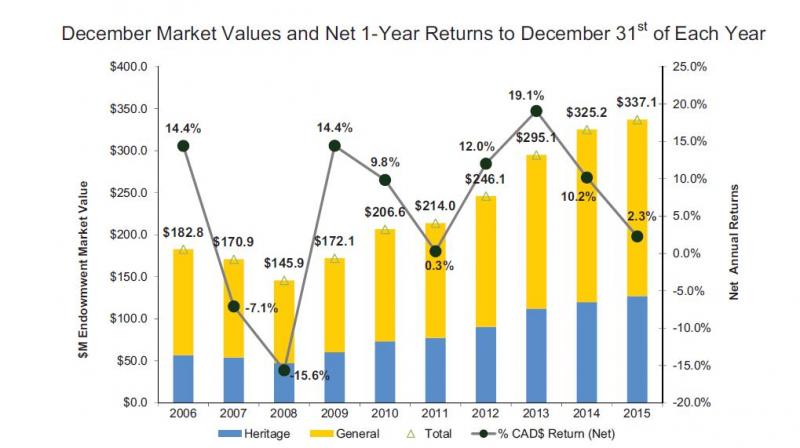

Growth of Endowment Assets

December Market Values and Net 1-Year Returns to December 31st of Each Year

Over the last 12 months the total Endowment portfolio increased $11.9 M to $337.1 M consisting of:

- Total contributions of $6.0 M and distributions of $1.4 M.

- 1-year return (net of investment management fees) of 2.3% compared to 10.2% for the year ended December 2014.