June 30, 2017 Endowment Quarterly Investment Report

Performance Review

University of Guelph Endowment Funds

2nd Quarter 2017

Prepared by:

Pavilion Advisory Group Ltd.

1250 René-Lévesque Blvd. West, Suite 4030

Montreal, Quebec

H3B 4W8 Canada

Endowment Funds Results Overview

(Net of fees returns for the 12 months ended June 30th, 2017)

The Total Endowment Funds gained 13.0% over the last 12 months, outperforming the unhedged benchmark by 2.0% and the hedged benchmark by 1.9%.

| Endowment Funds Results Overview | |

|---|---|

Canadian Equity

|

U.S. Equity

|

Non-North American Equity

|

Fixed Income

|

Total Endowment Portfolio Vs Endowment Policy Benchmark

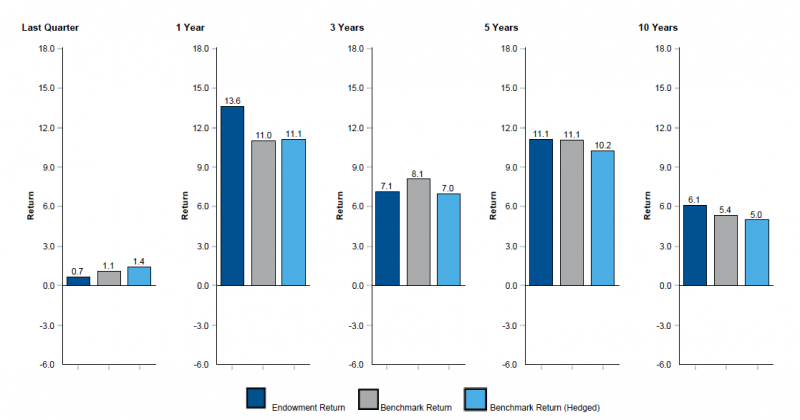

As of June 30, 2017 (Gross of Fees, Annualized for Periods over 1 Year)

Returns are presented gross of fees in CAD.

Endowment Policy Benchmark: 30% FTSE TMX Bond Universe + 7.5% Infrastructure (CPI+5%) + 17.5% S&P/TSX Composite + 20% S&P 500 ($CAD) + 20% MSCI EAFE Net ($CAD) + 5% MSCI Emerging Markets Index. The Hedged Endowment Policy Benchmark has the same composition as the Endowment Policy Benchmark, but all foreign indices are 50% hedged back to Canadian dollars since November 2010, 37.5% hedged since June 2017.

Asset Class Performance

As of June 30, 2017 (Gross of Fees)

| Allocation | Annualized Performance (%) | Annual Performance (%) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Market Value | % of portfolio | Quarter to Date | 1 year | 3 years | 5 years | 10 years | 2016 to 2017 | 2015 to 2016 | 2014 to 2015 | 2013 to 2014 | 2012 to 2013 | 2011 to 2012 | |

| Canadian Equity | 74,169,244 | 17.7 | -2.7 | 14.2 | 2.1 | 9.8 | 5.1 | 14.2 | -3.3 | -3.5 | 26.8 | 18.4 | -6.7 |

| S&P/TSX Composite Index | -1.6 | 11.0 | 3.1 | 8.7 | 3.9 | 11.0 | -0.2 | -1.2 | 28.7 | 7.9 | -10.3 | ||

| Relative Performance | -1.1 | 3.2 | -1.0 | 1.1 | 1.2 | 3.2 | -3.1 | -2.3 | -1.9 | 10.5 | 3.6 | ||

| US Equity | 89,858,577 | 21.4 | -0.2 | 19.5 | 16.5 | 20.9 | 10.6 | 19.5 | 4.6 | 26.6 | 27.4 | 28.1 | 7.7 |

| S&P 500 Index (CAD) | 0.4 | 17.9 | 17.1 | 20.3 | 9.3 | 17.9 | 8.2 | 25.9 | 25.8 | 24.8 | 11.4 | ||

| Relative Performance | -0.6 | 1.6 | -0.6 | 0.6 | 1.3 | 1.6 | -3.6 | 0.7 | 1.6 | 3.3 | -3.7 | ||

| Non-North American Equity | 89,879,678 | 21.4 | 3.3 | 21.6 | 9.3 | 15.4 | 6.1 | 21.6 | -2.9 | 10.8 | 26.9 | 23.4 | -1.9 |

| MSCI EAFE Composite | 3.6 | 20.8 | 8.5 | 14.6 | 3.5 | 20.8 | -6.1 | 12.7 | 25.3 | 23.3 | -8.5 | ||

| Relative Performance | -0.3 | 0.8 | 0.8 | 0.8 | 2.6 | 0.8 | 3.2 | -1.9 | 1.6 | 0.1 | 6.6 | ||

| Emerging Markets Equity | 21,501,509 | 5.1 | 1.3 | 30.3 | 8.5 | 10.8 | N/A | 30.3 | -10.8 | 9.7 | 20.6 | 8.6 | -10.9 |

| MSCI Emerging Markets Index | 3.6 | 24.2 | 8.4 | 9.5 | 4.3 | 24.2 | -8.1 | 11.6 | 15.8 | 6.8 | -10.9 | ||

| Relative Performance | -2.3 | 6.1 | 0.1 | 1.3 | N/A | 6.1 | -2.7 | -1.9 | 4.8 | 1.8 | 0.0 | ||

| Canadian Fixed Income | 115,651,862 | 27.6 | 1.2 | 0.3 | 4.0 | 3.6 | 5.4 | 0.3 | 5.3 | 6.3 | 5.5 | 0.5 | 9.4 |

| FTSE TMX Canada Universe Bond Index | 1.1 | 0.0 | 3.8 | 3.3 | 5.1 | 0.0 | 5.2 | 6.3 | 5.3 | -0.2 | 9.5 | ||

| Relative Performance | 0.1 | 0.3 | 0.2 | 0.3 | 0.3 | 0.3 | 0.1 | 0.0 | 0.2 | 0.7 | -0.1 | ||

| Infrastructure | 24,476,720 | 5.8 | 0.5 | 19.0 | 19.9 | N/A | N/A | 19.0 | 10.3 | 31.5 | N/A | N/A | N/A |

| CPI + 5% | 1.6 | 6.0 | 6.2 | 6.5 | 6.6 | 6.0 | 6.5 | 6.0 | 7.5 | 6.3 | 6.6 | ||

| Relative Performance | -1.1 | 13.0 | 13.7 | N/A | N/A | 13.0 | 3.8 | 25.5 | N/A | N/A | N/A | ||

| Internal Cash | 329,943 | 0.1 | -0.8 | -0.8 | -1.2 | -1.3 | 1.4 | -0.8 | -0.2 | -2.6 | -1.0 | -1.9 | 7.8 |

| FTSE TMX Canada 91 Day T-Bill | 0.1 | 0.5 | 0.6 | 0.8 | 1.2 | 0.5 | 0.5 | 0.9 | 1.0 | 1.0 | 1.0 | ||

| Relative Performance | -0.9 | -1.3 | -1.8 | -2.1 | 0.2 | -1.3 | -0.7 | -3.5 | -2.0 | -2.9 | 6.8 | ||

| Total Endowment Gross of Fees | 419,133,036 | 100.0 | 0.7 | 13.6 | 7.1 | 11.1 | 6.1 | 13.6 | 0.0 | 8.2 | 19.9 | 15.0 | 1.9 |

| Net of Fees | 0.6 | 13.0 | 6.5 | 10.5 | 5.5 | 13.0 | -0.6 | 7.4 | 19.4 | 14.5 | 1.4 | ||

| Relative Performance | 0.1 | 0.6 | 0.6 | 0.6 | 0.6 | 0.6 | 0.6 | 0.8 | 0.5 | 0.5 | 0.5 | ||

| Endowment Policy Benchmark (Hedged) | 1.4 | 11.1 | 7.0 | 10.2 | 5.0 | 11.1 | 1.4 | 8.8 | 18.4 | 12.1 | 0.6 | ||

| Relative Performance | -0.7 | 2.5 | 0.1 | 0.9 | 1.1 | 2.5 | -1.4 | -0.6 | 1.5 | 2.9 | 1.3 | ||

| Total Endowment (Gross of Fees) | 419,133,036 | 100.0 | 0.7 | 13.6 | 7.1 | 11.1 | 6.1 | 13.6 | 0.0 | 8.2 | 19.9 | 15.0 | 1.9 |

| Total Endowment ex. FX Overlay | 0.5 | 13.8 | 8.7 | 12.3 | 6.7 | 13.8 | 1.2 | 11.4 | 20.5 | 15.7 | 2.6 | ||

| Relative Performance | 0.2 | -0.2 | -1.6 | -1.2 | -0.6 | -0.2 | -1.2 | -3.2 | -0.6 | -0.7 | -0.7 | ||

Endowment Policy Benchmark (Hedged): 30% FTSE TMX Bond Universe + 7.5% Infrastructure (CPI+5%) + 17.5% S&P/TSX Composite + 20% S&P 500 ($CAD) + 20% MSCI EAFE Net ($CAD) + 5% MSCI Emerging Markets Index.. All foreign indices are 50% hedged back to Canadian dollars since November 2010, 37.5% hedged since June 2017.

All returns are reported gross of fees in CAD except for the Total Endowment where returns are displayed both net and gross of fees. EAFE stands for Europe, Australasia and Far East. Cash amounts and percentages presented exclude residual manager cash balances and currency overlay (currency hedging).

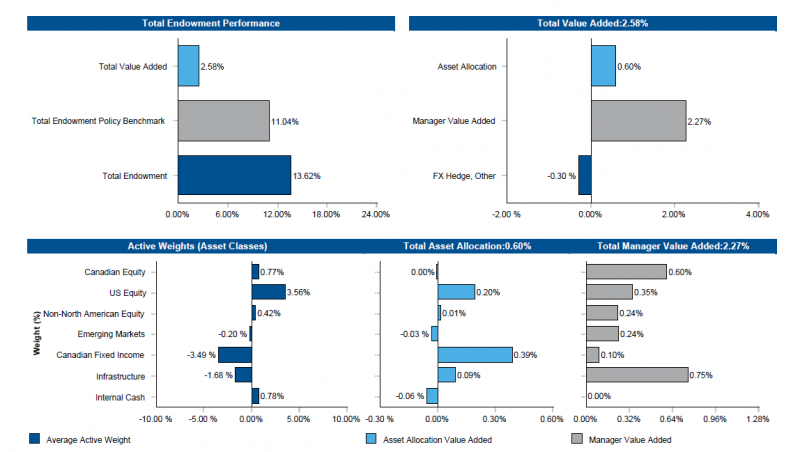

Performance Attribution

Total Endowment Funds Vs Endowment Policy Benchmark

1 Year Ending June 30, 2017

Returns are presented gross of fees in CAD.

Endowment Policy Benchmark: 30% FTSE TMX Bond Universe + 7.5% Infrastructure (CPI+5%) + 17.5% S&P/TSX Composite + 20% S&P 500 ($CAD) + 20% MSCI EAFE Net ($CAD) + 5% MSCI Emerging Markets Index.

The Benchmarks do not assume currency hedging.

“Other” includes the effects of all other factors on the Total Endowment's relative returns, including rebalancing and residual trading activity.

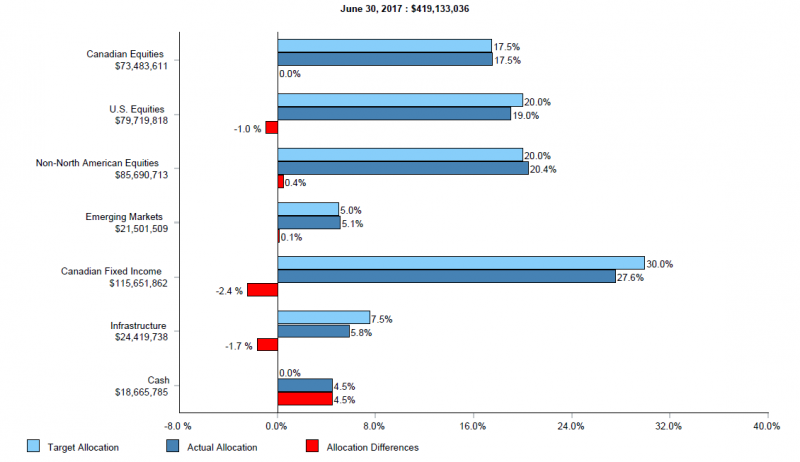

Endowment Asset Mix

Actual Allocation vs. Investment Policy Allocation

As of June 30, 2017

Note: This actual allocation displays the aggregate managers' holdings regardless of their mandate. Cash includes internal cash directly owned by the Endowments and manager residual cash balances (data from CIBC Mellon).

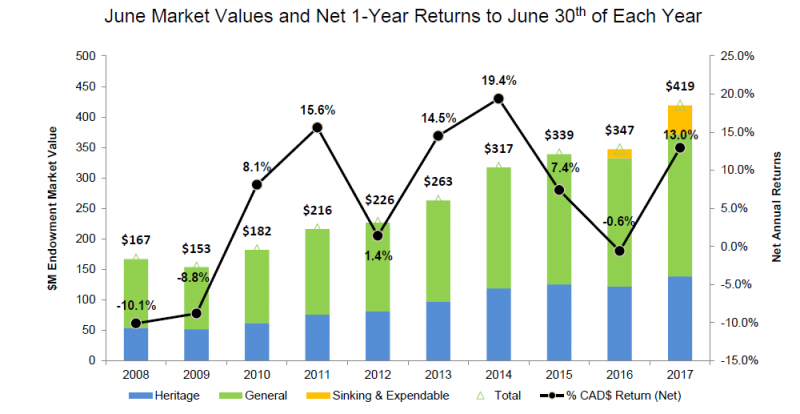

Growth of Endowment Assets

June Market Values and Net 1-Year Returns to June 30th of Each Year

Over the last 12 months the total Endowment portfolio increased from $347 M to $419 M consisting of:

– Total contributions of $34.2 M and distributions of $9.4 M.

– 1-year return (net of investment management fees) of 13.0% compared to -0.6% one year ago.

Per Expendable Fund Investment Policy approved by the Board on Jun. 3, 2016, all sinking funds and a portion of expendable funds are now invested in this portfolio.