Expendable Fund Investment Policy

University of Guelph

EXPENDABLE FUND INVESTMENT POLICY

Approved by the Board of Governors on Apr. 22, 2020

Contents

- Background

- Major Components of Expendable Funds

- Investment Objectives

- Expendable Fund Portfolio

- Funds Held for Debt Repayment (“Sinking Fund”)

- Overview of Expendable Funds

- Reporting

- Policy Review

1. Background

The University is responsible for the effective management of funds it receives from a large variety of government and non-government sponsors, customers and donors. The Expendable Funds investment policy provides direction on investments applicable to University-owned funds except those included in the long-term Endowment portfolio. The Endowment portfolio is invested under a separate Board-approved policy and is referenced in this policy only to provide context for the entire investment framework of University funds.

2. Major Components of Expendable Funds

The Expendable Funds consists of accumulated cash that is the result of temporary advances, deferred revenue, and net assets not immediately needed for cash disbursements. These funds can be invested to enhance investment income to be used in support of University operations. Most Expendable funds are invested in fixed income investments with very short durations where liquidity and short term capital protection are primary objectives, however where considered feasible, funds may be invested for longer terms via the Endowment portfolio with the purpose of enhancing returns. Allowable fixed income investments are defined in section 6. "Permitted Asset Classes" of the Endowment Investment Policy. The following are three sub-components of total Expendable Funds.

2.1 Designated Funds

There are times when major provincial or federal government funding ministries or agencies may require that certain funds restricted for special purposes be invested with accrued investment income, until spent. In these cases the University will hold these funds as “Designated Funds”. Investment of these funds is consistent with the Expendable Fund Portfolio in this policy, except where specified by a ministry or agency. Investment terms are matched to the expected cash flows of the Designated Fund. Major examples of this type of investment are funds advanced to the University for major capital purposes by federal and provincial governments.

2.2 Funds Held for Debt Repayment

Funds Held for Debt Repayment, referred to as an internal “Sinking Fund”, are internally restricted funds with the sole purpose of repaying long-term debt with non-amortizing principal. This debt structure requires that 100% of the debt principal be retired at the end of a term in the form of a single payment. The primary example of the University’s debt in this context is the $100 million 40 year debenture issued in 2002.

Under the University’s Capital Debt Policy, each year funds are set aside for investment into the internal Sinking Fund with the goal of having enough assets to fully retire the debt at maturity. These funds, while still reported as “Expendable Funds”, are managed separately due to their specific purpose and will be matched to the term of the debt they are designed to repay. (Note- given the long term investment horizon for the current debenture - funds will not be required until 2042 – current “Sinking Fund” contributions are invested in the University’s Endowment portfolio or long-term bonds. As the maturity date for the debenture arrives, funds will be “de-risked” and moved into shorter duration fixed income assets.)

2.3 Other Strategic Priorities

Where the strategic nature of the investment is deemed to be aligned with the University's strategic framework, an investment can be made that may otherwise be offside with the investment objectives noted in this policy. Any investments held for strategic purposes are not to be included in the Short-term EFP and are tracked and managed separately.

2.4 Expendable Fund Portfolio (EFP)

The balance of all University operating cash flows is captured under the category of the Expendable Funds Portfolio (EFP). This portfolio captures the residual of all University non- endowment investment activities.

3. Investment Objectives

The University manages the Expendable Funds with the three objectives of:

- Protection: Protection of capital, including the gradual reduction of purchasing power within the expected need for liquidity;

- Liquidity: Aligning available cash on-hand reserves with expected timing of cash outflows, and;

- Return: Maximizing the University’s return on funds for the purposes of supporting University operations. Where possible the University pools investments that match risk tolerance and expected cash flow requirements. In general, it is assumed that greater risk will be associated with greater, albeit uncertain, returns.

4. Expendable Fund Portfolio

4.1 Short-term Funds EFP

For funds identified as “Short-Term” the focus will be on protection and liquidity of the invested funds. The expectation is that these funds will allow for the payment, funding, or other discharging of financial obligations with no material risks to the fund balances. Investment returns for short- term funds are expected to align with the government of Canada’s risk free-rate reflecting the considerable focus on security and liquidity for the Short-Term managed Funds. All investment income earned on the Short-term EFP is immediately realized for use in University operations.

Credit Risk is managed by investing in a conservative pool of investment grade fixed income securities (BBB or higher – as rated by Standard & Poors - or equivalent recognized rating agency) or equivalent credit risk measure, with the following minimum thresholds:

|

Credit Risk |

Minimum |

Maximum |

|---|---|---|

|

AAA |

40% |

100% |

|

AA |

||

|

A |

0% |

60% |

|

BBB |

0% |

10% |

|

Below BBB |

Not to be purchased |

|

Concentration Risk from corporate issuers is managed through diversification of investment among several issuers. This is achieved through limiting any single corporate issuers to a maximum of 15% of the EFP at the time of purchase. There is no limitation on Government guaranteed issues.

| Concentration Risk by Corporate Sector | Target | Maximum |

|---|---|---|

| Investment Grade Corporate Issuer (Schedule 1 Banks) | 10% | 15% |

| Investment Grade Corporate Issuer (Non-Schedule 1 Banks) | 5% | 7.5% |

Pooled Funds:

External fund managers may be used where there are cost-effective fees and investment policies materially consistent with University investment objectives.

4.2 Long-term Funds EFP

Where it is expected EFP funds can be invested for longer terms, a portion of the EFP may be invested in the Endowment fund with the goal of enhanced long-term return. In determining the portion of the EFP feasible for long-term investment, the Primary Reserve ratio1 target, as defined in the Annual Financial Report will be used. The target for this ratio indicates the University’s long term goal to maintain a certain on-going level of reserves (liquidity) providing an opportunity for enhanced long-term returns. Linking long-term funds to the Primary Reserve ratio will help maintain a strong financial base for the University while generating additional investment income for annual operational needs.

Long-Term Funds and Investment Income

The maximum total investments in long-term portion of the EFP will be based on 20% of the Primary Reserve ratio target. This maximum threshold for EFP funds to be held within the University’s Endowment portfolio with a long-term investment mandate. Investment income generated from the long-term EFP will be subject to the same policy provisions that govern the Endowment fund. University management will monitor the Primary Reserve ratio and the long-term portion of the EFP to ensure the 20% threshold is not exceeded at time of investment.

5. Funds Held for Debt Repayment (“Sinking Fund”)

5.1 Investment Time Horizon

Funds that are internally restricted for future debt repayment, or as an elective Sinking Fund, will be invested to maximize the benefit to the University. The specific time horizon will match each specific debt agreement.

When the investment time horizon is for the long-term, the funds will be invested within the University’s Endowment portfolio with a long-term mandate. As the Sinking Fund approaches the need for funding the payout the funds will transition from the Endowment portfolio to short-term funds within the EFP. Investment income from invested assets related to a Sinking fund will be reinvested for future retirement of the debt.

6. Overview of Expendable Funds

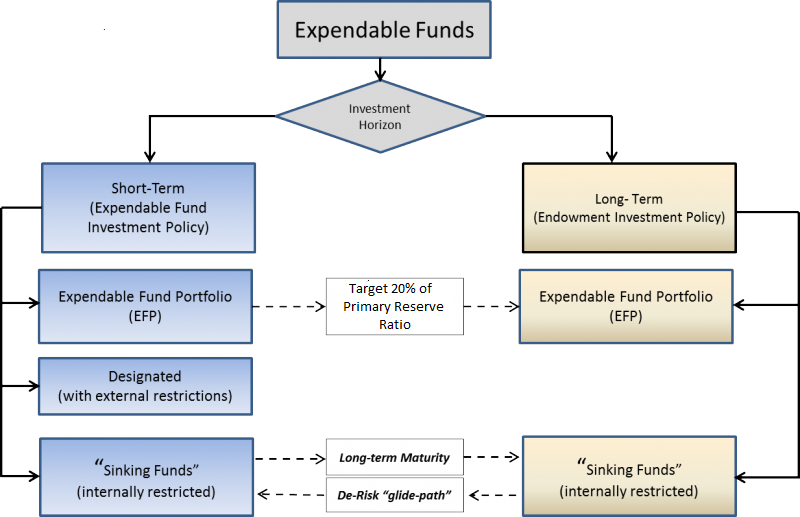

The diagraph below presents the Expendable Fund investment structure. Funds under “Long – Term” are invested through the University’s Endowment portfolio. In addition “Sinking Funds” may be invested in the Endowment portfolio, best matching the maturity date of the associated debt repayment requirement. The “De-Risk glide path” indicates that as the maturity date of a debt repayment approaches, any Sinking Fund investments in the long-term (Endowment portfolio) will be “de-risked” into fixed income, short-term assets.

* Assets invested in Long-Term Funds are invested within the Endowment portfolio

7. Reporting

The administration shall report at least annually through the finance Committee to the Board of Governors on:

- Portfolio balances and asset allocation

- The maturity of the investments

- Performance of the portfolios

8. Policy Review

This policy will be reviewed by the AVP, Finance and Services at least once per year. If any amendments are necessary, these amendments may be made only after approval by the Board of Governors of the University.